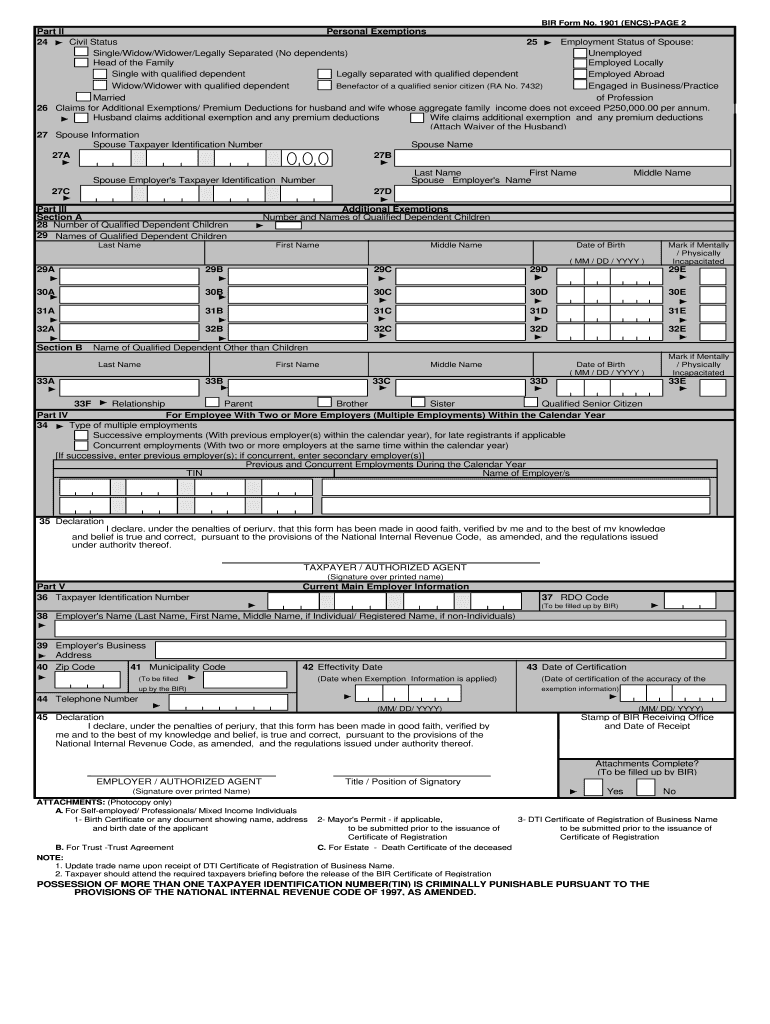

What is BIR 1901 Form?

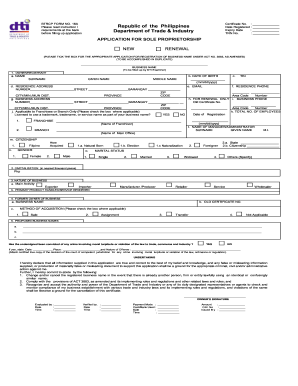

The BIR Form 1901 is the Application for Registration for Self-Employed and Mixed Income Individuals, Estates/Trusts. This document requires accomplishment of a Revenue District Office (DO) with the appropriate jurisdiction over the head office or particular branch. This form is used for the registration of self-employed and mixed-income individuals, opening of new branch, and estates or trusts about to start to a business.

Who would file BIR 1901 form?

BIR Form 1901 is used for the registration of self-employed and mixed-income individuals, estates or trusts with start-up businesses, and when opening/registering a store’s nebranchnc— — all of which for filing their taxes.

Is BIR 1901 Form Accompanied by Other Documents?

BIR Form 1907, on the other hand, is the Application for Permit using Cash Register Machines/Point-of-Sale Machine. All taxpayers opting to use such equipment in place of having official receipts/invoices should accomplish this particular document for all their cash depository needs, before use of chosen machine. Similar to the BIR Form 1901, the DO does the necessary completion of document, given that they have jurisdiction over the head office or branch.

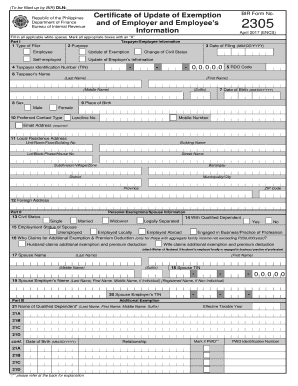

What Information do I Provide in BIR 1901 Form?

BIR FORM 1901 for Individual is filed in three fully accomplished copies. Every taxpayer should use the latest version of BIR forms, provide all the possible information / complete all the details required on the form, like Taxpayer Identification Number (TIN) Taxpayer’s Complete Name / Company Registered Name (for Corporation), Business Address, Zip Code, Product: (e.g. Wood Furniture, Jewelries, Bamboo/Rattan Handicrafts etc.) indicated at the back of the form, Email Address and Contact Number/s, Signature. Title/Position of Signatory and TIN of Signatory for Corporation.

When and Where do I Send BIR 1901 Form?

This must be filed with the DO having jurisdiction of said head or branch office, on or before the start of the new business or before any tax due or return is to be paid or filed. Filing must be completed prior to the definite use of the loose-leaf or computerized books of accounts or also referred to as the accounting records.